Welcome to Rebound Capital. Here we conduct deep research into beaten-down stocks and study companies that made a successful comeback. Subscribe for free and join 5,000 other investors to make sure you don’t miss our next briefing:

First, some big news :)

Now, on to some even bigger news!

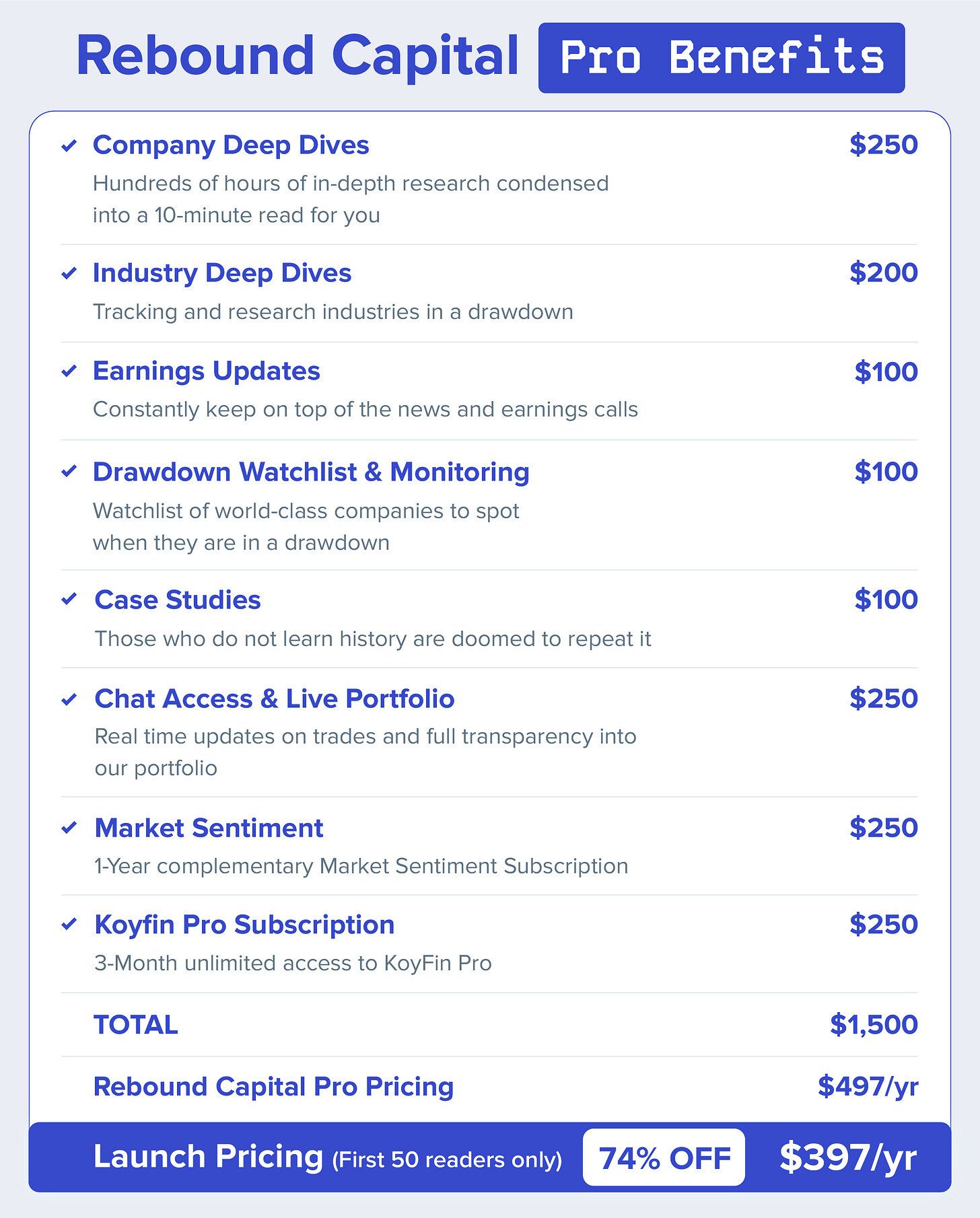

Tomorrow at 3:00 PM EST, Rebound Capital will transition into a full-fledged investment platform. Here’s everything you will get:

Only 1% of you (50 seats) will be eligible for the early bird pricing of $397/year ($33/per month). Once these 50 spots are filled, prices will go up ($497/year).

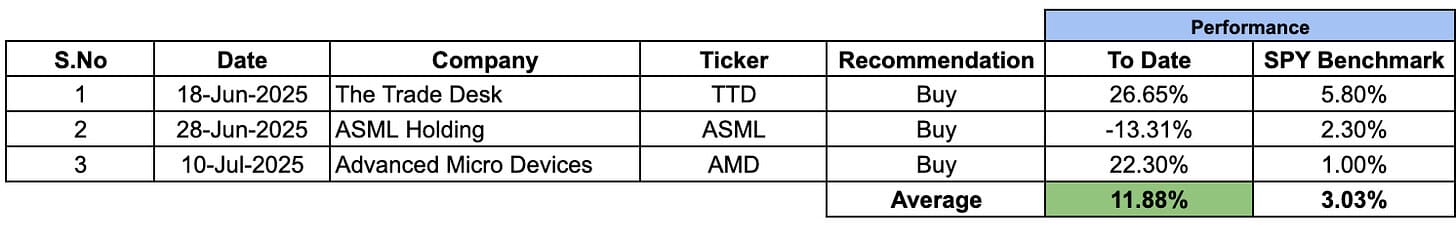

Rebound Capital “Buy” Recommendations Performance

On average, our buy recommendations have provided 4x the return of the S&P 500.

To put this in perspective, even if you are running a $10K portfolio on this strategy, the alpha generated in 2 months alone would be more than enough to pay for 2 years of Rebound Capital subscription.

Let’s dig into what went right and what went wrong:

The Trade Desk ($TTD)

When we covered it, the stock was down 42% from its ATH due to missing revenue guidance and a slow and buggy rollout of its AI platform. Our thesis was that the leadership remained highly competent and would resolve the AI implementation issues. This is how we concluded:

Given the management track record, the current drawdown might be just another speed bump in the long run!

The stock is up 27% since we covered it.

Others seem to be picking up on this as multiple investment banks (RBC, UBS, Jefferies, etc.) have lifted their target for the Trade Desk last week. We also got a small lucky break as the company got added to the S&P 500.

ASML Holding ($ASML)

When we did the deep dive in June, the stock was down 33% in the last year due to a mix of a slowing industry cycle and uncertainty related to tariffs and U.S.-Chinese relations.

ASML is definitely a long-term investment for us as it’s the only company capable of manufacturing EUV lithography machines, and we are nowhere near running out of steam on the AI hype train.

But, at least as of now, the pain does not seem to be over. The stock is down 13% since our recommendation. Even though the company had beaten the estimates for revenue and EPS on its latest earnings call, ASML issued weak guidance for 2026 due to geopolitical uncertainties.

Our opinion remains that the market has severely over-reacted, and we will keep adding to our position.

Advanced Micro Devices ($AMD)

This was our best call to date. The stock is up 22% in the last 3 weeks.

The deep dive was captioned betting on the underdog, and we were right on the money. AMD’s new Instinct MI350 series chips appear to be performing as claimed and may be starting to take market share away from Nvidia.

Get a small entry now (given the decent valuation and strong momentum) and then add or remove from the position based on real-world performance reports from AMD’s new AI data center chips. — AMD Deep Dive (July 10th)

Just last week, AMD increased the price of its Instinct MI350 AI accelerator from $15,000 to $25,000 (always a good sign). Yet, even after this massive 67% hike, AMD's artificial intelligence chip is still cheaper than Nvidia's.

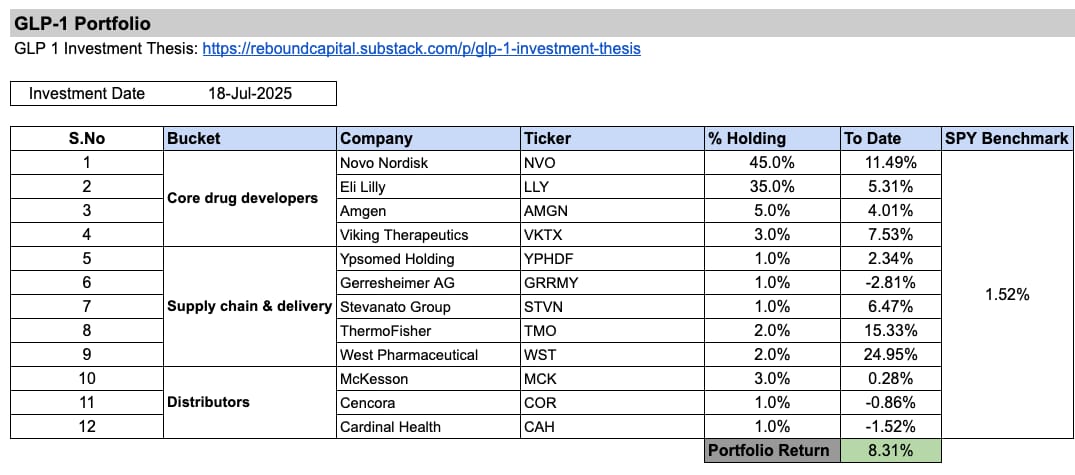

GLP-1 Portfolio

We launched our GLP-1 portfolio exactly 2 weeks ago. To say that it has been volatile would be the understatement of the year.

Portfolio performance as of last Friday:

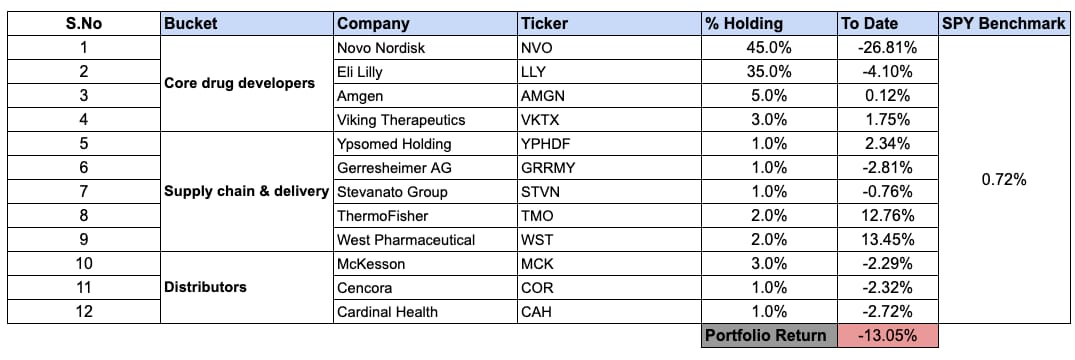

Portfolio performance as of today:

What happened?

Novo Nordisk announced its earnings. While we have covered in detail the earnings report on X, the main reason for the massive drop was guidance cuts. Sales guidance is down to 11% from 17% and operating profit is down to 13% from 20%. The drop primarily stems from the slow growth of Wegovy (GLP-1 drug) in the U.S. market.

Does our thesis change?

Slightly, but not enough to act and change the portfolio allocation now. I underestimated the stickiness of unregulated drugs. Despite the FDA grace period ending in May, unsafe compounded GLP-1 drugs remain widely available - and cannibalize licensed GLP-1 drugs. We have to follow closely now how effectively the Govt is enforcing its crackdown on the unlawful market.

Either they are successful, in which case we can retain the portfolio as is, or we will have to diversify into other players, such as HIMS, which is also getting a piece of the action. Overall, the GLP-1 thesis remains strong — Only the players might change. Eli Lilly is expected to announce its earnings on August 7th, which will provide more visibility into whether it’s a company-specific issue or an industry-wide problem.

Drawdown Stocks Performance

Here’s a snapshot of all the stocks we have covered and their performance to date. On average, drawdown stocks that we covered had 2x the return of the S&P 500 (albeit with much higher volatility)

We actively keep track of these stocks and update any key developments and their earnings snapshots in our chat.

It’s often said that you get the customers you deserve. If that’s true, we consider the quality of our readers to be the best compliment we could hope for! Thanks for all the support, and see you tomorrow!